|

| Welcome to the Stepnowski Law Offices |

The Law Office of Edward L. Stepnowski (1924 - 2013)

The Law Office of Frank E. Stepnowski

1515 N. Harlem Ave., suite 205-2

Oak Park, Illinois 60302

telephone (708) 848-3662, 848-3663

fax (708) 844-4001

Welcome to our site.

Located in Oak Park, Illinois, we are dedicated to giving our clients the highest degree of legal services.

About us:

Frank E. Stepnowski was born in Chicago,

Illinois, and attended Fenwick High School. He earned a

degree in Economics from the University of Dallas and

graduated from Northwestern University Law

School. He was admitted to practice in the

State of Illinois in 1984, the Northern District of

Illinois in 1984, and the United States Supreme Court in

1988. He clerked for the Illinois Appellate Court

for four years, and has worked in private practice since

then.

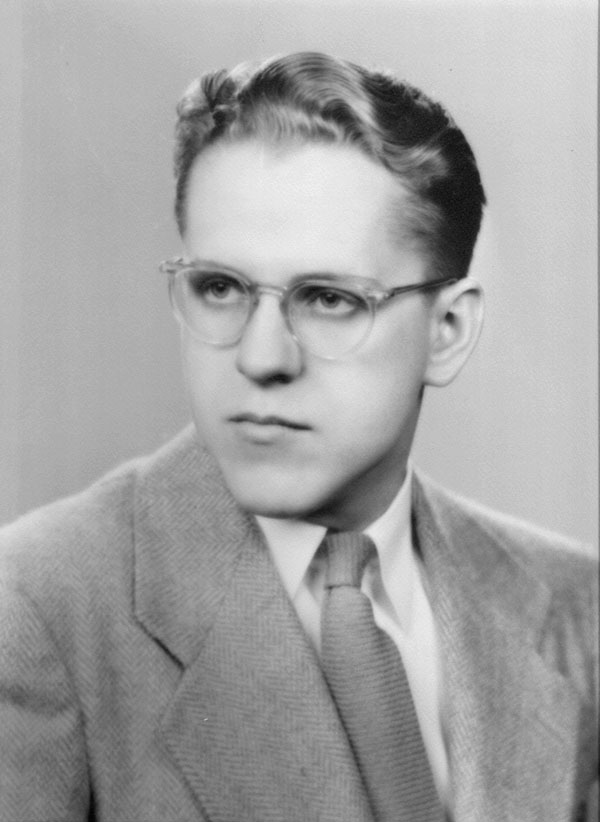

Edward L. Stepnowski (1924 to 2013) was born in Chicago, Illinois. During World War II, he served first with the Army Specialized Training Program and then with the 326th Airborne Regiment. He graduated from dePaul University Law School and was admitted to practice in the State of Illinois in 1950. He was admitted to practice before the U.S. District Court for the Northern District of Illinois, and the United States Supreme Court. He was a 63-year member of the Chicago Bar Association, and received the meritorious service award from the Advocates Society. Mowie po polsku.

The 1515 North Harlem Building is the only modern building designated as a landmark in Oak Park, a village filled with historic and beautiful houses.

Frank recently won appeals against a health insurer which attempted to pay only $50,000 on hospital bills of $600,000. The hospitals and doctors then tried billing the patient for the balances. After the appeals, the insurer paid the claims with no further cost to the patients. He is recently published an article in the Illinois Bar Journal on the operation of health insurance "narrow networks" and "balance billing."

In 2013, he was a panelist addressing the Chicago Bar Association Probate Law Committee in a discussion webcast to its members. He addressed current legislation pending in Illinois protecting people with disabilities and proposed changes to the guardianship laws.

Articles and Resources

Click here for the Parents of

Children with Disabilities LibraryThese articles discuss tax deductions for those with disabilities, the Americans with Disabilities Act, insurance, and other laws to help those with disabilities.

Important new reasons for updating

your Last Will and Testament (2017)

- Digital Assets require more estate planning. Illinois has passed legislation in 2016 to recognize the importance of digital assets and electronic communication. More and more of our bank accounts, investments, and personal history are kept only on-line. Your family must have access to that information, but the new laws require you to take affirmative steps to allow your heirs, or your guardian if you become disabled, to gain access to your assets, even when for your own benefit. Contact your lawyer to make sure your Will and other documents comply with the new laws.

- I often must cringe when I see many Do-It-Yourself Wills. While the DIY revolution has many benefits, I see too many cases where people unintentionally disinherit their children's widows and orphans, the very heirs who need your help the most. Simply following a form and copying "legal-sounding" language is not enough to assure your intentions are met. The cost of seeing an attorney is small compared to the consequences of not having your Will reviewed by an experienced counselor.

- While using a Will can save your estate thousands of dollars and bring certainty, often a better solution involves changing the title on your real estate. This act can help your assets pass to the next generation without having to admit your Will into the Probate Court.

- If your child or grandchildren has a disability, your gift to him or her should be placed into a specialized trust. Otherwise your gift may disqualify them from Medicaid, housing or other benefits.

- While a will is valid when signed by two witnesses, if

an interested party demands proof, the court may require

the witnesses to appear and verify the signatures.

When a will is old, often the executors have trouble

locating the witnesses. Refreshing your will not

only makes you think about your next generation's

current needs, it allows you to get more accessible

witnesses.

Wills and Estate Planning Frequently Asked Questions (FAQ)

Protect your new graduate with a power of attorney

Prince's death illustrates importance of having a will

Living Trusts, Frequently Asked Questions (FAQ)

Federal court certifies class action for seniors applying to Medicaid. On March 29, 2018, the Federal District Court in Chicago in Koss v. Norwood, certified a class of members who applied for nursing home coverage and have not received a final eligibility determination or a notice of an opportunity for a hearing within 45 days of the date of application in non-disability cases or 90 days in disability cases. Then the court ordered the State to:

Medicare, the health coverage for seniors, offers only limited coverage for extended care or nursing homes. Senior must use private, separately purchase long-term care insurance, or spend down their asets. Medicaid will cover this care only when the senior has impoverished his or her assets. The application for medicaid is complicated, but an experienced attorney can preserve some of your loved-one's assets and thus improve the quality of life while under care. Prior to the Koss case, the State was taking too long to approve Meidcaid applications.(a) determine, on or before June 28, 2018, the eligibility of Class Members for the long-term care Medicaid benefits for which they have applied;

(b) implement policies and processes to ensure that the defendants prospectively comply with the Medicaid Act’s deadlines for eligibility determination found in 42 U.S.C. § 1396a(a)(8) and 42 C.F.R. 435.912;

(c) beginning June 28, 2018, pay the long-term care and other Medicaid benefits to (or for the benefit of) Class Members while their applications remain pending beyond the Medicaid Act’s deadlines for eligibility determination.

New: Power of Attorney forms

The State of Illinois recently changed the Power of Attorney Act. The law enabled new forms for the Power of Attorney for Health Care and Power of Attorney for Property. Both forms are important for protecting your future and estate planning. They designate someone to act on your wishes if you become disabled or suffer a medical emergency. Call your attorney to discuss which forms can help you. An experienced attorney can modify the forms to meet your specific needs and provide for situations that the legislature did not consider. Every adult should have these forms before an emergency strikes.

New: Transfer on Death Instruments

Illinois has a new law permitting a deed to transfer residential property upon death, but is this deed always best for your situation? Will a land trust provide more benefits? Ask your attorney. Recently, many people have come to us because their parents or spouses died without preparing for the transfer of the title of their residences. Now the children are stuck in costly proceedings to clear the title to prevent foreclosure, to deal with a bank, to refinance the mortgage, to deal with freeloading siblings, to find distant relatives who may get a share of the house, or even just to repair the house.

If you own a home, putting your home in joint tenancy, a land trust, or a TODI can save your loved ones from worry, drawn-out proceedings, and expenses. Properly prepared, you can get the title deed in their names without giving up your control of the property. Preparing the title is relatively inexpensive and often more important than a signing a Last Will and Testament.

The article about Prince above notes several estate planning failures:

- Consider a father with grown children who have sweet memories of the home where they were raised. With no will, a second wife could inherit the house and give it to her own children from her previous marriage, leaving out the children who were raised in that house.

- On the other hand, second wives have been left homeless because a husband died without updating an old will to incorporate a second wife. In an old will, he leaves his home and everything else to his children.

- Many people don't write wills because they assume they are young and have plenty of time. Yet Prince was only 57 years old.

- Families should revisit the will every few years because as time passes, one asset can gain value a lot while another loses.

Contact Us:

1515 N. Harlem Ave., suite 205-2

Oak Park, Illinois 60302

telephone: (708) 848-3663, 848-3662

fax: (708) 848-0219

|

|